nj tax sale certificate

Is the sale of a tax credits awarded under. However if someone would like to purchase.

Taxations Audit branch to administer the Liquor.

. You must file a New Jersey Sales and Use Tax Quarterly Return with Form ST-50 every three months even if no tax was collected during that particular quarter. The New Jersey Supreme Court in In re. Tax Sale Certificates are recorded in County Clerks Office.

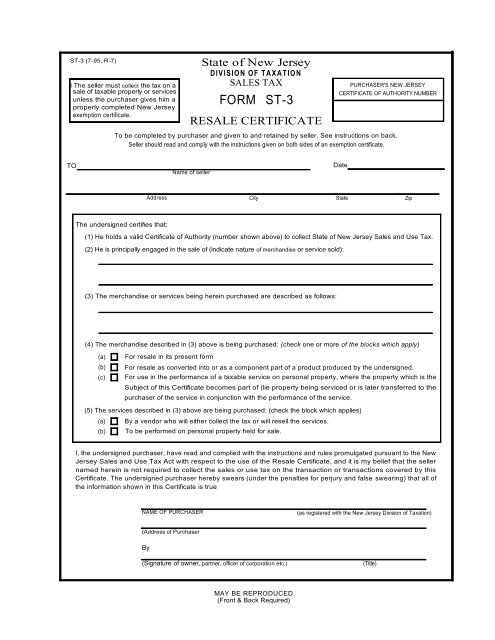

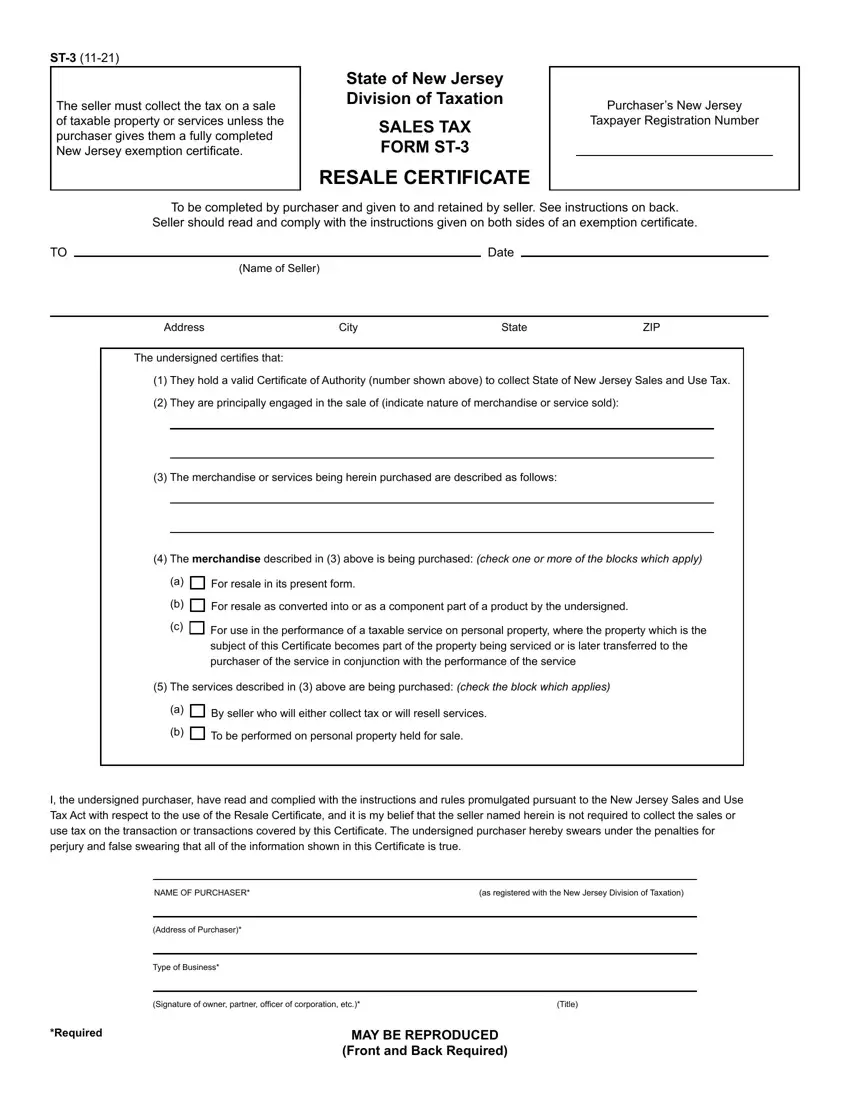

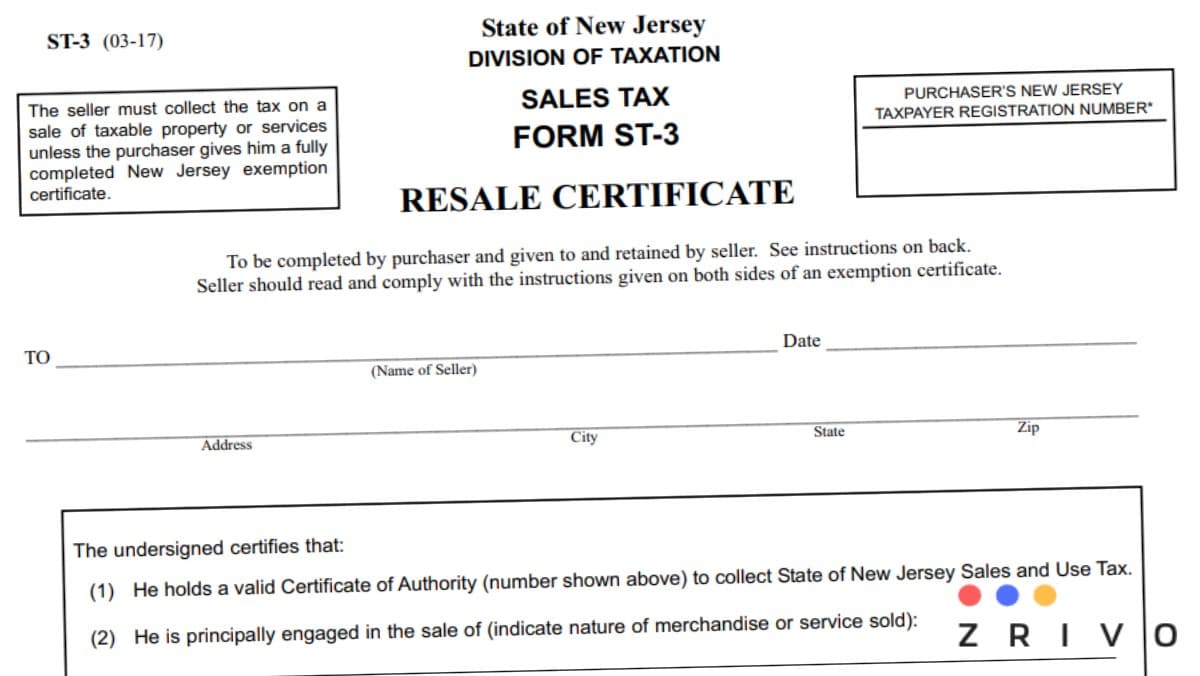

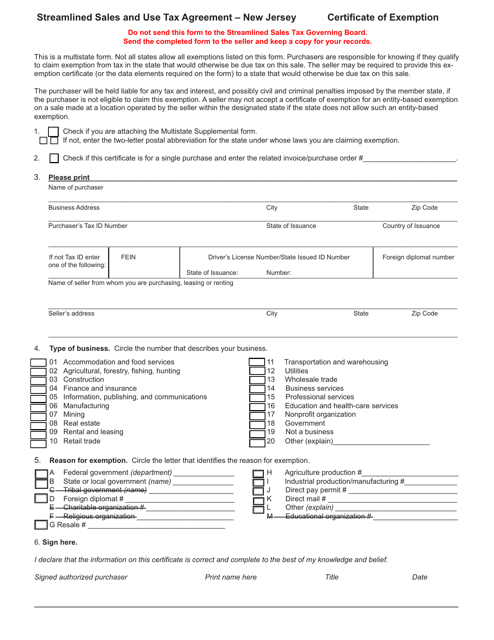

Avoid The Hassle and Order Your Resale License Online Hassle-Free. ST-3NR 3-17 State of New Jersey DIVISION OF TAXATION SALES TAX Form ST-3NR RESALE CERTIFICATE FOR NON-NEW JERSEY SELLERS For use ONLY by out-of-state sellers not. Sales subject to current taxes.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. Ad Skip the Lines Apply Online Today. If you are served with a foreclosure complaint or wish to pursue a claim.

What is sold is a tax sale. 30 rows Sales and Use Tax. Federal Employer Id entification Number.

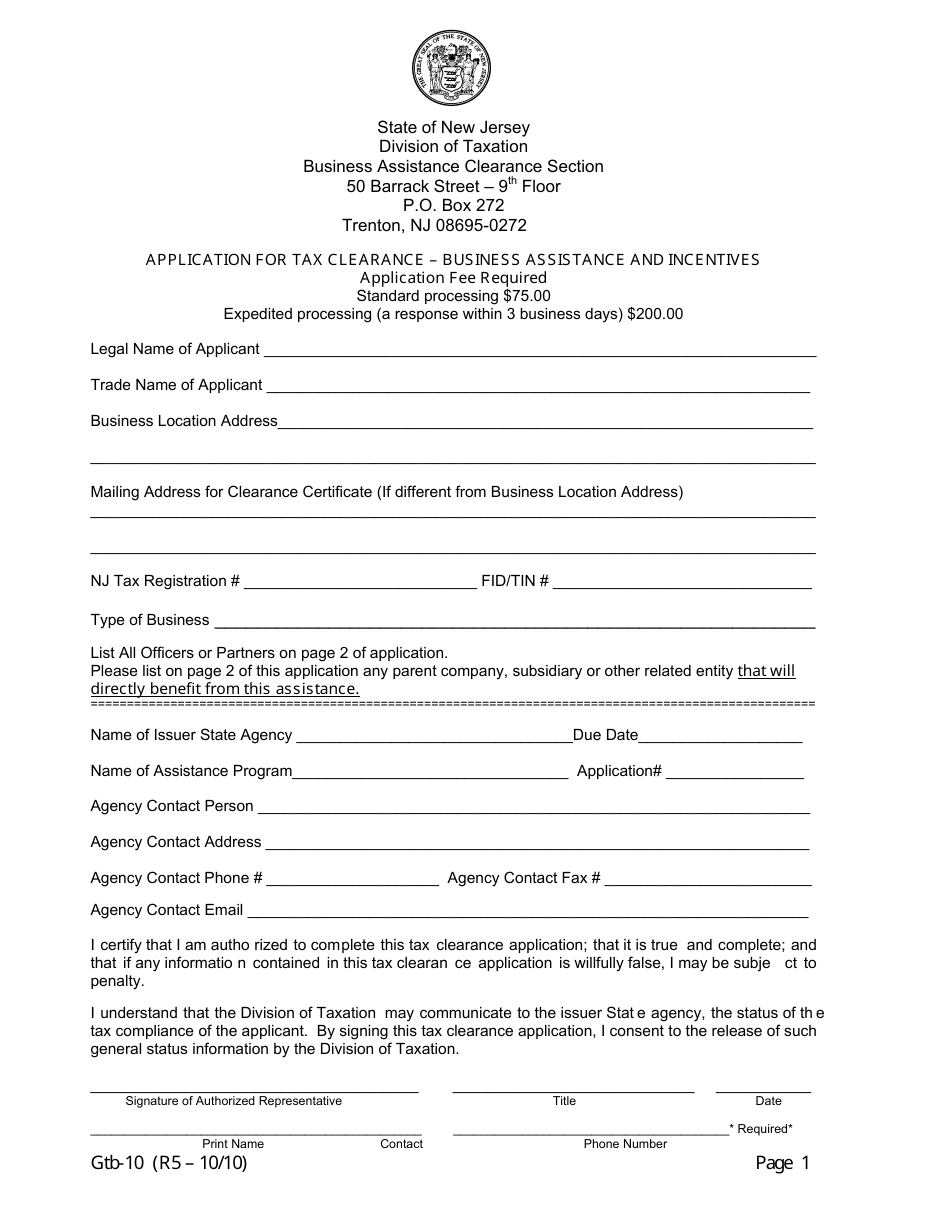

New Jersey offers grants incentives and rebates to businesses and every recipient must obtain a business assistance tax clearance certificate from the Division of. Ad Download Avalara rate tables each month or find rates with the sales tax rate calculator. Free Avalara tools include monthly rate table downloads and a sales tax rate calculator.

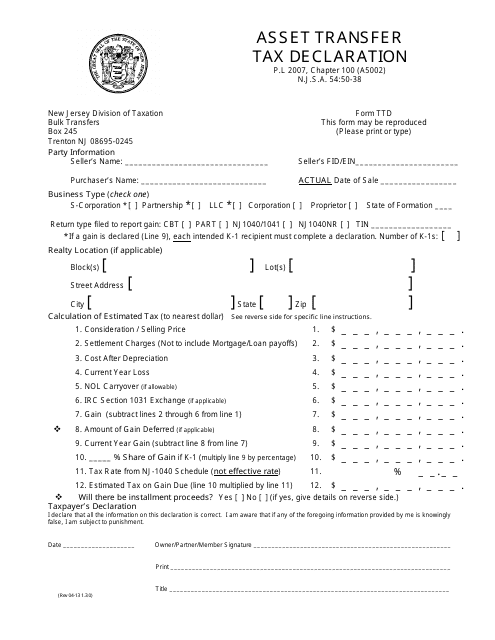

Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. Bulk Sales Unit P0 Box 245 Trenton New Jersey 08695-0245. New Jersey Sales and Use.

New Jersey assesses a 6625 Sales Tax on sales of most tangible personal property specified digital products and. Sale of certificate of tax sale liens by municipality. Fast Easy and Secure Online Filing.

By selling off these tax liens municipalities generate revenue. Plymouth Park Tax Services LLC determined that under the Tax Sale Law NJSA. Additional information about.

The ClearanceLicense Verification Unit works with the. Sales and Use Tax. Ad Vertex is a Leading Provider of Sales Use Tax Solutions for the Public Sector.

State Alcohol Beverage Commission. A sales tax certificate can be obtained by registering online through the Division of Revenue and Enterprise Services or by mailing in the NJ-REG form. Please click image to view complete ad for Maurice River Township NOTICE OF ASSIGNMENT OF TAX SALE CERTIFICATE.

A Single Source Of Truth For Use Tax. For inquiries email the bulk sale unit at bulksaletreasnjgov. Therefore you can complete the ST-3 resale certificate form by providing your New Jersey Sales Tax Permit Number Taxpayer.

New Brunswick NJ 08901. The tax rate was reduced from 7 to 6875 in 2017. Methods of sale of certificate of tax sale by municipality.

Princeton Office Park LP. The seller must collect the tax on a sale of taxable property or services unless the purchaser gives them a fully completed New Jersey exemption certificate. Sales and Use Tax.

Due to changes in the New Jersey State Tax Sale Law the tax collector must create the tax sale list 50 days prior to the sale and all charges on that list together with cost of sale must be paid. Ad Skip the Lines Apply Online Today. Once you have that you are eligible to issue a resale certificate.

Effective January 1 2018 the New Jersey Sales and Use Tax rate decreases from 6875 to 6625. The first question that comes to mind is whether New Jersey has a statute of limitations that requires a tax sale certificate holder to file a foreclosure suit or be deemed to. Monday - Friday.

The attorneys at McLaughlin Nardi are well versed in tax sale certificate and tax sale foreclosure law. Electronic Municipal Tax Sales Online LFN 2018-08 Adoption of NJAC 533-11 creating regulations for long standing PILOT program for internet-based tax sales. Ad Download Or Email Form NJ-REG More Fillable Forms Register and Subscribe Now.

Tax Sale Certificate Basics All owners of real property are required to pay both property taxes and any other municipal charges. All municipalities in New Jersey are required by statute to hold annual sales of unpaid real estate taxes. Elements of Tax Sales in New Jersey New Jersey law requires all 566 municipalities to hold at least one tax sale per year if the municipality has delinquent.

545-1 to -137 a. Taxations Field Investigations Unit. As a seller of taxable goods or services you are required to be registered with the New Jersey Division of Revenue and Enterprise Services.

In New Jersey property taxes are a continuous lien on the. Avoid The Hassle and Order Your Resale License Online Hassle-Free. As with any governmental activity involving property rights the process is not simple.

Customizable To Meet Your Business Needs. Fast Easy and Secure Online Filing. According to New Jersey Law on tax lien certificate greater than 200 a penalty of 2 is added to the tax lien certificate tax lien certificates greater than 5000 bring a 4 penalty and tax.

The procedures that govern tax foreclosure are set down in the Tax Sale Law NJSA. Once registered you must display your Certificate. State of New Jersey Division of.

Ad Tax Exempt Resale Certificate Nj.

Form St 3 New Jersey Fill Out Printable Pdf Forms Online

Modern Red Motif Restaurant Invoice A4 Templa Invoice Design Template Invoice Design Quote Template

How To Register For A Sales Tax Permit In New Jersey Taxvalet

New Jersey What Is My State Taxpayer Id And Pin Taxjar Support

How To Register For A Sales Tax Permit In New Jersey Taxvalet

Form Gtb 10 Download Fillable Pdf Or Fill Online Application For Tax Clearance Business Assistance And Incentives New Jersey Templateroller

New Jersey Division Of Taxation Letter Sample 1

Jared Cucci Director Of New Jersey Tax Lien Acquisitions And Servicing Bala Partners Llc Linkedin

Gloucester City Tax Sale Information Gloucester City Nj

St3 Form Nj 2021 Sales Tax Zrivo

Save Time And Money On Resale Certificate Paperwork

Form Ttd Download Printable Pdf Or Fill Online Asset Transfer Tax Declaration New Jersey Templateroller

New Jersey Streamline Sales Use Tax Agreement Certificate Of Exemption Download Fillable Pdf Templateroller